Customer Assistance Programs in a Covid World

Here at AQN, we talk to a lot of leaders in the consumer and small business lending industry. I think we may have talked to more CEOs, Chief Credit Officers, and Chief Operational Officers in the last two weeks than over any prior two week period. Everyone is more open to sharing information as they try to develop an industry consensus on where the world is headed. It is an honor to have so many peoples’ ears and to be in that flow.

This week, the questions we hear most are about Customer Assistance Programs. Lenders of all stripes are looking for ways to better work with customers and to accommodate their rapidly changing and diverse needs in this crisis. The thing we most often tell them is that there isn’t just one answer. The best response can differ a lot based on your asset class, customer type, business model, and individual situation. What works for one lender may not work for another.

Some lenders have seen customer service and collections capacity devastated by site closures and are unable to handle new operational procedures. Some lenders worry about their exposure to small businesses and gig economy workers that will likely face the hardest hits in this downturn. Other lenders have distinct geographic footprints that make impacts to their customer base much heavier or lighter, at least at the present moment.

And of course the possibility of congressional action hangs over this whole discussion. The current stimulus package does not include many provisions in earlier House bills that would have tied lenders hands, but future and more local action is definitely still possible.

Even amid this uncertainty, AQN organizes the multiple considerations when working with lenders into 4 broad buckets:

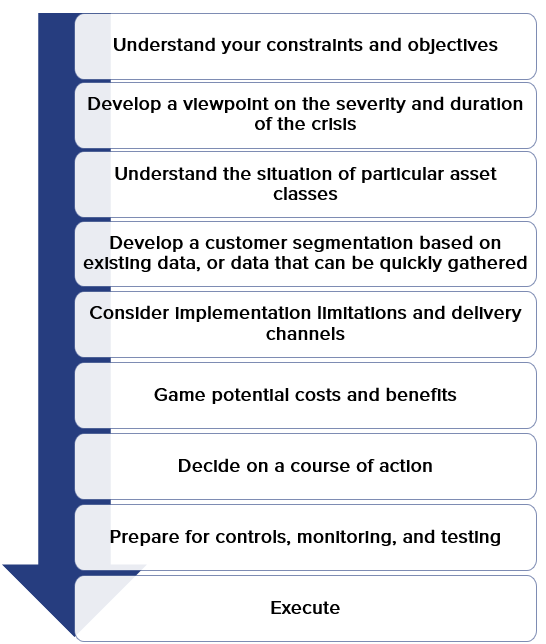

This is a crucial, complicated, yet high stakes set of considerations, and there is no single answer for everyone. However, there are answers that can mean differences of tens of millions of dollars to lenders, can have substantial impact on customers, and can have meaningfully different levels of operational complexity. Being rigorous and thoughtful, and leveraging experts is definitely strongly recommended. At AQN we have a disciplined and rigorous process that is run by our experienced team of senior practitioners to guide your management team toward the right decisions. Our framework is proven, includes rapid cycle times to support the need to respond quickly, and includes the following steps:

Lenders need to move with haste, but also with clarity. Inaction and knee jerk reactions both carry big risks. And if you think you could benefit from experienced, unbiased, and informed advice through the process, please don’t hesitate to reach out to us at AQN. Helping lenders with their most difficult and consequential decisions is what we do every day.